If someone in Poland owes you money and refuses to pay, you may need to take legal action. Polish law provides a structured process for recovering debts through the courts. Whether you’re a private individual, a company, or a foreign creditor, it’s important to understand your options—from sending a final demand for payment to obtaining a court judgment and enforcing it.

1. Final notice

Before initiating court proceedings, it is good to send the debtor a final pre-litigation demand for payment. This document sets a clear deadline for payment and warns the debtor about the risk of litigation if the debt remains unpaid. In certain cases, such a notice is even legally required—for example, if no specific payment date was previously agreed, this step is necessary in order to trigger default interest.

2. Lawsuit

A lawsuit should generally be filed with the court having jurisdiction over the debtor’s place of permanent residence. If the claim is under PLN 100,000, the case should be filed in the District Court (Sąd Rejonowy), if it exceeds this amount – the appropriate venue is the Regional Court (Sąd Okręgowy).

The lawsuit must include:

- the claimant’s full name, address, and PESEL number (if applicable),

- the defendant’s name and address

- a precise statement of claim—the amount owed, the basis of the claim,

- specification of the date on which the claim became due,

- information on whether the parties attempted mediation or another form of alternative dispute resolution

- all supporting evidence, including full names and addresses of witnesses as well as documents, such as contracts, invoices, or correspondence confirming the debt.

The lawsuit is subject to a court fee, which is usually around 5% of the amount claimed. Proof of payment of the fee must be submitted together with the lawsuit. If the defendant loses the case, the final judgment will typically order them to reimburse the claimant for the court fee.

3. Litigation process

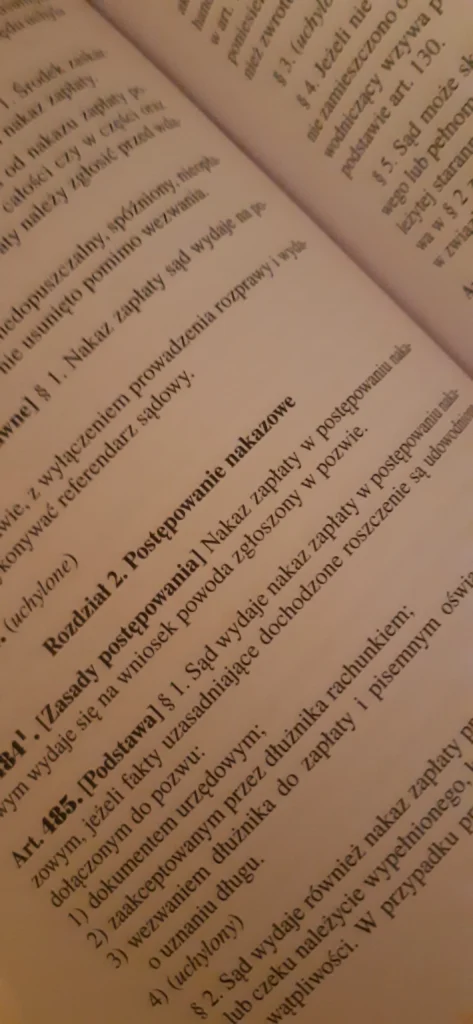

If the claim is properly documented, the court may issue a payment order in an expedited written procedure—without holding a hearing. If the defendant does not object within two weeks of receiving the order, it becomes enforceable.

If the defendant files an objection, the case proceeds to a full trial, during which the court examines witnesses, hears both parties and reviews all relevant evidence.

It is also possible to apply for interim relief, such as a freezing order on funds held in the debtor’s bank account, to secure the claim during litigation.

After the judgment is delivered, the losing party may file an appeal. Although appeal proceedings are generally less complicated, they can take longer due to court backlogs and the volume of pending cases.

4. Enforcement of the judgement

Once a judgment becomes final, it must be enforced. In Poland, enforcement is carried out by a court enforcement officer (komornik sądowy)—a public official, somewhat similar to a bailiff. To initiate enforcement, you must file an application for enforcement and submit the enforceable copy of the court judgment (with a seal of enforceability).

The bailiff will then initiate actions to recover the debt, such as garnishing wages, seizing bank accounts, or attaching assets.

The above information provides a simplified overview of debt recovery proceedings in Poland.

If you need legal assistance, feel free to call (+48 608 393 623) or send an email (kotowska.kancelaria@gmail.com).

0 komentarzy